ETF

美股投資

美國龍頭企業ETF競爭白熱化!SPY、VOO、IVV、SPLG誰才是美股代表?

近日,摩根大通啟動為期十年的「安全與韌性倡議」(Security and Resiliency Initiative)計畫,總規模高達1.5兆美元,帶動製造業回流與科技創新雙引擎,聚焦強化美國經濟安全的四大關鍵領域——供應鏈與先進製造、國防與航太、能源自主與韌性,以及前沿與戰略科技。此舉不僅是金融業對去風險化與產業重組的最新回應,也被視為美國重建國安級產業鏈的重要里程碑。想更了解這四大方向如何轉化為投資機會?以下延伸閱讀將帶你一一探索,掌握全球競局下的美股投資脈動!

一、供應鏈與先進製造:

小金屬、大戰略 稀土如何牽動全球供應鏈博弈 哪些稀土概念股和ETF值得留意?

二、國防與航太:

飛向宇宙 浩瀚無垠 哪些美國太空概念股和ETF掌握太空兆元新商機?

政策引擎發動 美國無人機急速升空!哪些無人機概念股和ETF最受矚目?

美國國防預算飆升 從先進戰機到核動力航母 哪些軍工股與ETF最熱門?

三、能源自主與韌性:

核能股怎麼選?從電力公司、鈾礦商到核能新創 這些個股和ETF最受矚目!

四、前沿與戰略科技:

AI風險推升資安需求 哪些資安股和ETF掌握資安產業投資機會?!

摩根大通宣布啟動「安全與韌性倡議」新聞稿中文翻譯

摩根大通宣布啟動「安全與韌性倡議」(Security and Resiliency Initiative),是一項為期十年、總額達1.5兆美元的計畫,旨在促進、融資並投資於對國家經濟安全與韌性至關重要的產業。

在此新計畫中,摩根大通將直接進行最高100億美元的股權與創投投資,協助主要位於美國的企業推動成長、激發創新並加速戰略性製造。

摩根大通董事長暨執行長Jamie Dimon表示:「美國已讓自己過度依賴不可靠的關鍵礦物、產品與製造來源──而這些正是國家安全的基石。我們的安全奠基於美國經濟的力量與韌性。美國需要更快的行動與更多投資,同時也必須清除障礙:過度的監管、繁瑣的官僚程序、黨派僵局,以及未能與所需技能接軌的教育體系。」

這項計畫正值美國致力於現代化基礎建設、強化供應鏈與推動經濟成長之際。摩根大通將聚焦以下四大重點領域,透過顧問、融資,並在部分情況下投入資本,支持各規模與發展階段的企業:

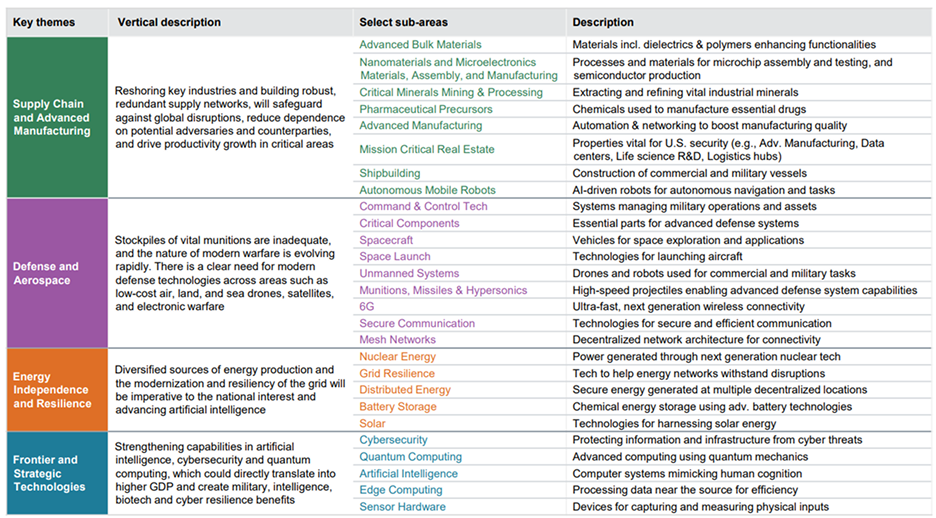

更具體地說,該公司目前已將這四大領域細分為27個子領域,涵蓋造船、核能、奈米材料與關鍵防禦零件等範疇。

摩根大通原本已計畫在未來十年為這些產業的客戶提供約1兆美元的融資與促進活動。隨著新增的資源與資本,該公司將把金額再提高至多5,000億美元,相當於增加50%。這些業務將橫跨中型市場公司與大型企業客戶。

Dimon補充說:「這項新計畫包括確保能穩定取得救命藥品與關鍵礦物、保衛國家、建構符合AI需求的能源系統,以及推動半導體與資料中心等技術。我們對這些產業客戶的支持將持續堅定。」

投資關鍵產業的歷史基礎

摩根大通在全球金融服務領域已有逾兩百年歷史,長期扮演支持美國利益的重要角色。該公司擁有獨特的地位,可加速推動強化韌性與促進創新的投資,不僅在美國,也遍及全球。摩根大通擁有深厚的關係網絡──服務 34,000 家中型企業與超過 90% 的《財星500大》公司,同時是領先私募與創投機構的重要合作夥伴。其商業與投資銀行部門已連續超過 15 年位居全球首位,與國防、航太、醫療與能源產業保持長期關係,並在這些產業中多次主導重大交易。

運用公司專業能力

鑑於此計畫的重要性與商機,摩根大通將擴充銀行家、投資專業人員與相關專家團隊,並成立由公私部門領袖組成的外部顧問委員會,以指導長期策略。

該倡議還將針對私營企業與供應鏈議題(特別是稀土、人工智慧與科技)進行主題性研究,並結合新設立的「地緣政治中心」(Center for Geopolitics),為客戶提供全球趨勢的即時分析與洞察。

此外,摩根大通的資產與財富管理部門(Asset & Wealth Management)也將參與,該部門已持續研究並投資於多個關鍵產業。這項努力也將結合公司自身在量子運算、網路安全與 AI 研究方面的技術投資。

政策層面同樣關鍵。摩根大通將倡議推動有助於成長的政策,包括研發、許可、採購與監管等領域。隨著銀行加強對這些產業的聚焦,也將與社區及商業夥伴緊密合作,推動人才培育與技能訓練,以確保企業能填補關鍵職位。

Dimon最後表示:「希望美國能再次如以往那樣,團結一致應對這些巨大挑戰。我們必須立刻行動。」

摩根大通宣布啟動「安全與韌性倡議」新聞稿英文原文

JPMorgan Chase today announced the Security and Resiliency Initiative, a $1.5 trillion, 10-year plan to facilitate, finance and invest in industries critical to national economic security and resiliency. As part of this new initiative, JPMorgan Chase will make direct equity and venture capital investments of up to $10 billion to help select companies primarily in the United States enhance their growth, spur innovation, and accelerate strategic manufacturing.

“It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing – all of which are essential for our national security,” said Jamie Dimon, Chairman and CEO of JPMorgan Chase. “Our security is predicated on the strength and resiliency of America’s economy. America needs more speed and investment. It also needs to remove obstacles that stand in the way: excessive regulations, bureaucratic delay, partisan gridlock and an education system not aligned to the skills we need.”

The firm's effort comes at a time when the U.S. is looking to modernize infrastructure, fortify supply chains, and implement policies that promote growth. JPMorgan Chase will focus on the following four key areas, supporting companies across all sizes and development stages by offering advice, providing financing, and, in some cases, investing capital:

More specifically, the firm has currently divided these four key areas into 27 sub-areas, ranging from shipbuilding and nuclear energy to nanomaterials and critical defense components.

The firm had already planned to facilitate and finance approximately $1 trillion over the next decade in support of clients in these important industries. With additional resources, capital and focus, JPMorgan Chase aims to increase this amount by up to $500 billion—or a 50% increase. These activities will cut across both middle-market companies and large corporate clients.

Dimon added, “This new initiative includes efforts like ensuring reliable access to life-saving medicines and critical minerals, defending our nation, building energy systems to meet AI-driven demand and advancing technologies like semiconductors and data centers. Our support of clients in these industries remains unwavering.”

JPMorgan Chase has been a leader in global financial services for more than 200 years, playing a critical role in supporting America's interests. The firm is uniquely positioned to accelerate investments that enhance resiliency and drive innovation across industries in the United States and around the world. The firm has extraordinary relationships – serving 34,000 mid-sized companies and more than 90% of the Fortune 500 – and is a key partner to leading private equity and venture capital firms. Its Commercial & Investment Bank has been the top investment bank for more than 15 years with long-standing relationships in the defense, aerospace, healthcare and energy sectors, and a proven track record advising on landmark transactions in those industries.

Given the expected business opportunities and significance of this mission, JPMorgan Chase will hire more bankers, investment professionals and other experts to address this critical initiative. Additionally, the firm will create an external advisory council of experienced leaders from the public and private sectors to help guide the long-term strategy.

The initiative will also include special, thematic research on private companies and supply chain management issues related to rare earths, AI and technology. It will also be complemented by the firm's recently launched Center for Geopolitics, which provides clients with timely analyses and insights on top global trends. In addition, the firm's effort is supported by our Asset & Wealth Management division, which already researches and invests in many of these critical industries. This effort will be further informed by JPMorgan Chase's own technology investments, including quantum computing, cyber security and AI research and capabilities.

Policy is essential, too, and the firm will advocate for policies that can accelerate these efforts, including research and development, permitting, procurement and regulations conducive to growth. As the bank intensifies its focus on these essential industries, it will also continue to work closely with its community and business partners to champion these sectors, foster talent and support skills training to ensure companies can fill critical jobs.

Dimon concluded, “Hopefully, once again, as America has in the past, we will all come together to address these immense challenges. We need to act now.”

Source:JPMorgan Chase